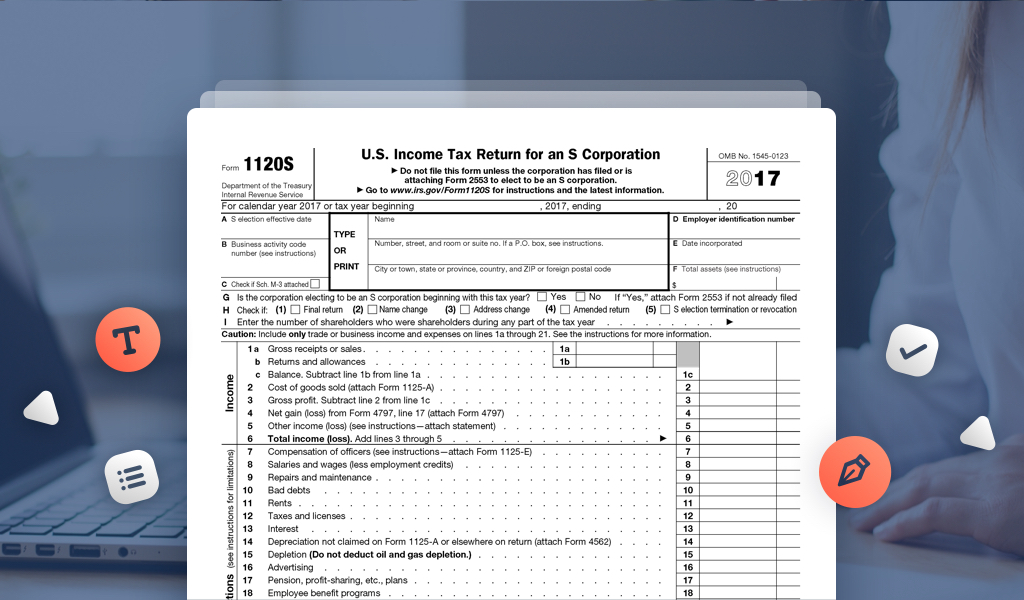

Schedule K-1 Form 1120s 2024 Schedule – The Schedule K-1 must be filed by the same deadline as the Form 1120S. Two copies of the Schedule K-1 must be completed for each shareholder. One copy goes to the shareholder, while the other copy . The types of forms to filled for an S Corporation and an LLC are a 1120 S along with Schedule K-1. The form that will be filed for a C Corporation, is 1120. The form that will be filed for a sole .

Schedule K-1 Form 1120s 2024 Schedule

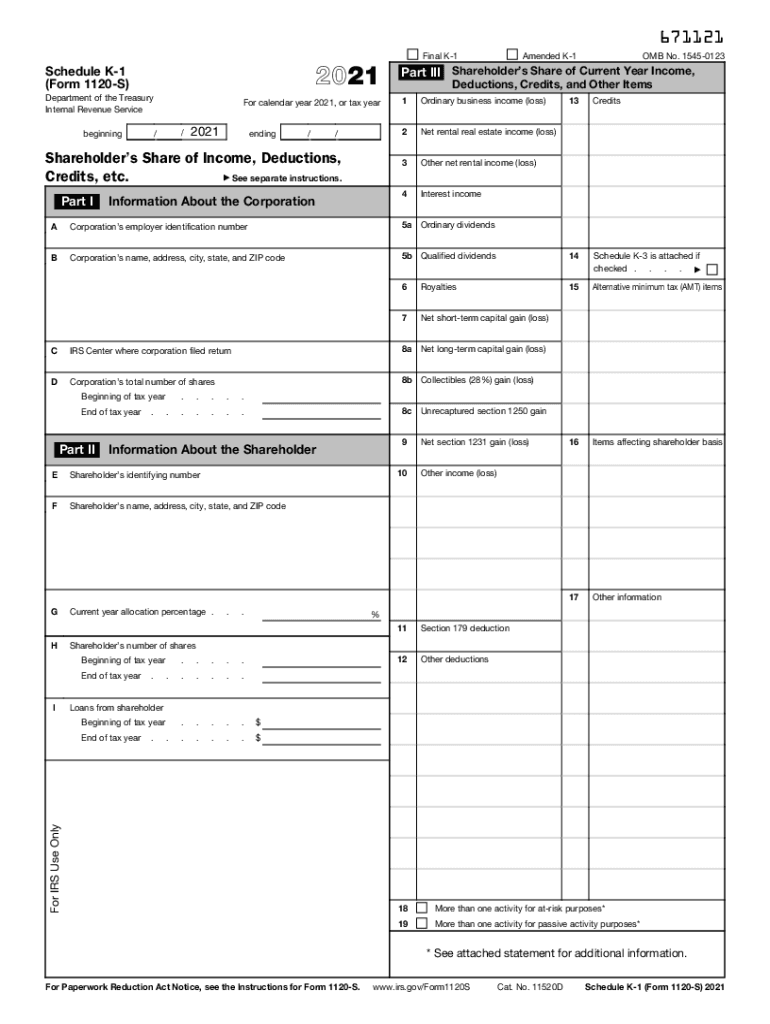

Source : www.nelcosolutions.comSchedule K 1 (Form 1120 S) Shareholder’s Share of Income

Source : support.taxslayer.comIRS Schedule K 1 (1120 S form) | pdfFiller

Source : www.pdffiller.comDon’t Miss the Deadline for Reporting Your Shareholding Income

Source : blog.pdffiller.comK 1 box 17 code ac gross receipts: Fill out & sign online | DocHub

Source : www.dochub.comSchedule K 1: What Is It?

Source : www.thebalancemoney.comIRS Instruction 1120S Schedule K 1 2022 2024 Fill and Sign

Source : www.uslegalforms.comWhat is K1 for Taxes 2021 2024 Form Fill Out and Sign Printable

Source : www.signnow.comSchedule k 1 form 1120s 2021: Fill out & sign online | DocHub

Source : www.dochub.comHow Do I Fill Out a Schedule K 1? | Gusto

Source : gusto.comSchedule K-1 Form 1120s 2024 Schedule 120SK11204 Form 1120 S Schedule K 1 Shareholder’s Share of : Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . Businesses electing to be taxed as an S corporation will prepare Form 1120-S, declaring their income for the year. Like a partnership, you’ll prepare a Schedule K-1 to declare each shareholder’s .

]]>

:max_bytes(150000):strip_icc()/ScheduleK-1-8a50434b740e4fb8b76341312f0e7f69.png)